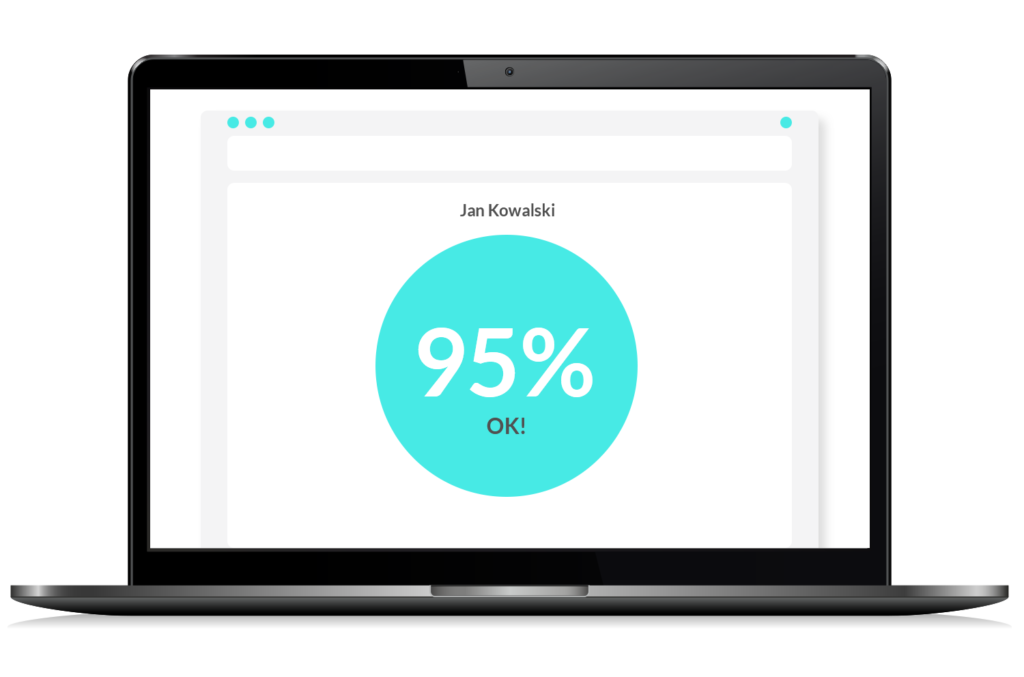

Our solutions help to estimate the credit risk. The customer credit assessment is based on own models using machine learning. The models we have created automatically assess the customer creditworthiness. The uses the data from:

- the customer account in compliant with Directive PSD2

- Biuro Informacji Kredytowej S.A.

- BIG InfoMonitor S.A

- CRIF Sp. z o.o.

We create the credit risk models in compliance regulations (e.g. published by the Polish Financial Supervision Authority) for products such as:

- Instalment loan

- BNPL

- credit card limit