We make the digital identification simpler

We implement digital identification solutions supporting online services. We offer the biggest possible flexibility of tools that comply with legal requirements and principles of effective customer service.

Consulting

Products

Implementation

Maintenance

KPIs

We create comprehensive profiled and individual customer identification systems. We provide not only the technology, but also the full implementation in the scope needed by a customer at a given moment. We support or sometimes even replace IT departments. The customer may select and implement specific features of a system on their own. We can also fully configure a customer verification system in compliance with the requirements of a specific branch.

Complex customer onboarding in digital channels.

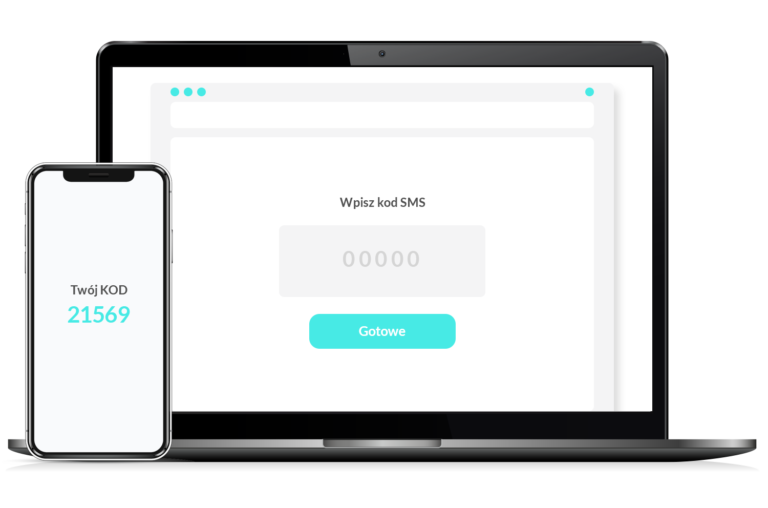

Enables remote and safe identity confirmation KYC (Know Your Customer)

The customer credit assessment is based on own models using machine learning. The models we have created automatically assess the customer creditworthiness.

Effective fraud prevention.

Thanks to us, remote conclusion of agreements is simple, quick and safe. We reduce formalities and increase convenience.

Panel support for sale and post-sale processes – ustomer management, contract management.

Various communication channels

The ecosystem of our services is adjusted to various communication channels depending on the customer needs:

Full online process

communication must be quick, light and nice, without distractors. A purchase decision is made very quickly in this case. Conversion depends on the manner of operation of the system.

Online process supported by a call centre

non-bank loans or microfactoring sometimes require additional consulting. Our products support successful communication in this respect.

Hybrid process online combined with offline

a leasing, in which customers undergo an online process, but come personally to the store to take a car and sign a take-over report

BNPL

deferred repayments

Non-bank cash loans

Financing of cards

Mikrofaktoring

Prouniq‘s solutions accelerate the verification process and increase the safety of entire operation. We take account of the diversity of the target groups, legal provisions that are different for each product and unique methods of customer interaction.